Key Highlights:

- Grinex has approached $1 billion in USDT (Tron) transaction volume within just weeks of launching.

- Funds are flowing between Grinex and dozens of licensed exchanges — many of which enforce KYC and AML standards.

- Significant direct and near-direct transfers to major exchanges raise questions about compliance vulnerabilities and risks to exchanges.

Just days after the sanctioned crypto exchange Garantex was shut down, its successor Grinex quickly became operational. And its operations are gaining traction — at least with major exchanges.

Through on-chain analysis, Global Ledger reveals Grinex’s transaction volumes with global exchanges in its recent research.

How Grinex Built Volume Through Regulated Exchanges

As of today, inbound and outbound USDT (Tron) transactions have each reached $1 billion. These aren’t speculative wallet movements or isolated whale trades. The volume represents a complex web of high-frequency inflows and outflows, much of it tied to major exchanges that are supposed to “flag” this kind of activity.

Ties to major licensed exchanges

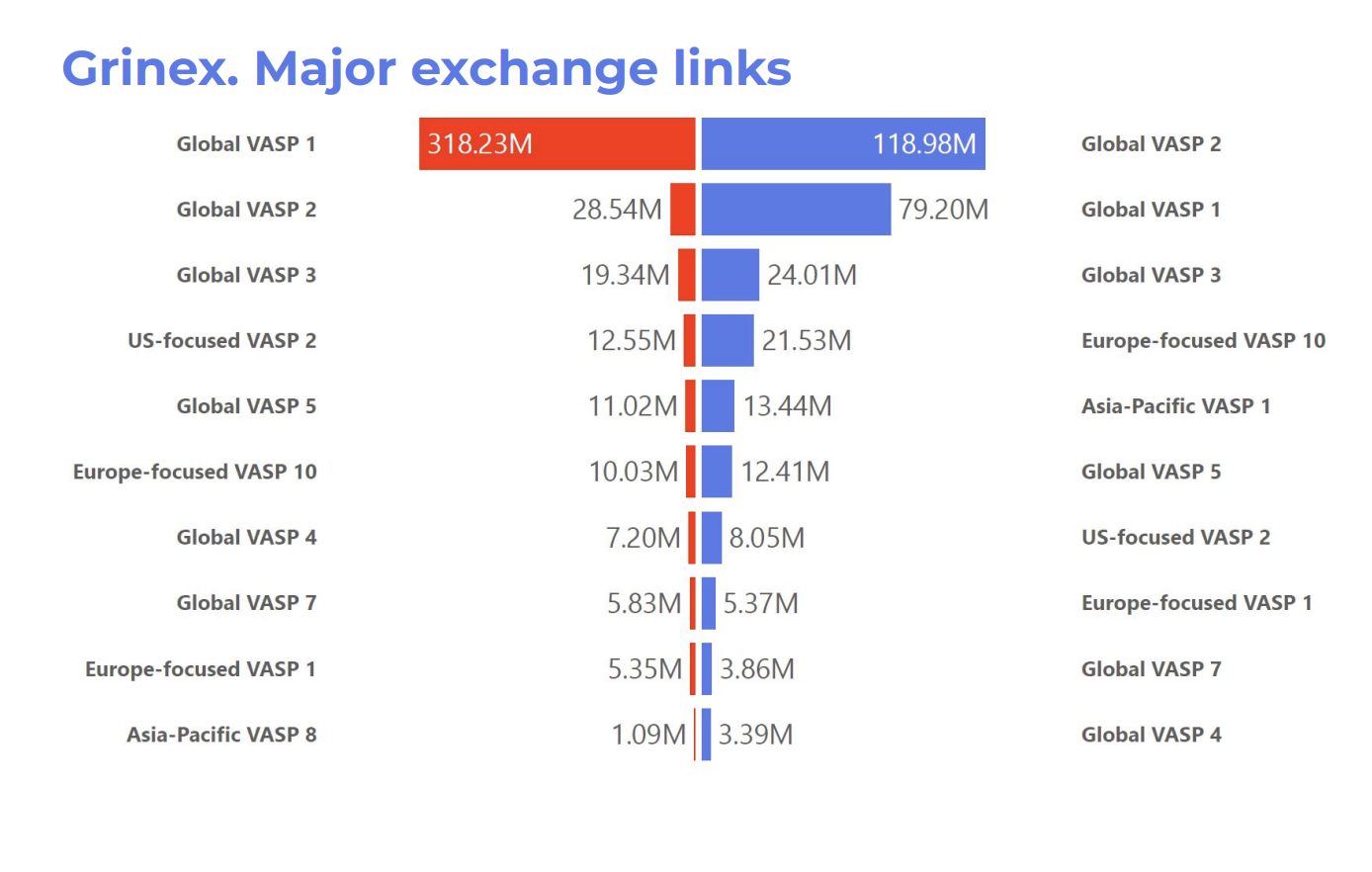

Global Ledger’s daily volume analysis of the top 10 global exchanges reveals visible on-chain flows within Grinex wallets. These are not isolated events: in many cases, substantial volumes are involved, and the transaction paths are short.

Tens of millions in USDT routed through licensed platforms, with the red and blue sections indicating Grinex’s incoming and outgoing flows, respectively.

Direct transfers raise red flags

Grinex’s rapid integration into the broader crypto ecosystem becomes even more concerning when looking at direct and near-direct on-chain flows. Global Ledger analysts identified transactions between Grinex-linked wallets and 58 licensed exchanges.

A closer look reveals a pattern of minimal-hop transfers — in some cases, funds move through just one intermediary wallet before reaching major, regulated platforms.

For example, several notable flows illustrate the minimal effort required for Grinex funds to reach major platforms:

- Direct transfer

In one case, over $191,000 in USDT was sent directly from a Grinex-linked wallet to one of the world’s largest crypto exchanges. No intermediary wallets were involved.

- One-hop transaction

Another example involved a $500,000 transfer that passed through just one other wallet before arriving at a Europe-based virtual asset service provider (VASP).

- Another one-hop case

In a similar transaction, a Grinex wallet sent funds through a single intermediary before they landed at one of Europe’s largest exchanges.

As of April 23, 2025, over $788 million in transactional exposure has been identified — much of it linked to exchanges based in the Asia-Pacific region or operating under global jurisdictions.

What’s next

Grinex’s rapid emergence underscores a deeper issue: even fully compliant, KYC-enforcing exchanges can unknowingly become part of high-risk flows. While Grinex itself isn’t under sanctions, its clear connection to the previously sanctioned Garantex raises important questions. This connection alone warrants closer scrutiny and timely detection of a “high-risk” transaction.

However, with the right tools, you can spot risks early — not just react after the fact. Global Ledger can help you see what others might miss with our blockchain visualization technology and crypto AML risk-scoring solution. See how it works.