TOKEN2049 Dubai brought together more than 15,000 attendees from over 160 countries to discuss the future of crypto, regulation, and real-world adoption.

Representing Global Ledger, Lex Fisun (CEO & Co-Founder), Yulia Murat (Head of Regulatory Affairs), and Carlos Yanez (Business Development Manager) engaged with regulators, industry leaders, and compliance professionals — gaining valuable insights into the region’s increasing demand for KYT (Know Your Transaction) tools and solutions.

TOKEN2049 Sum-Up

The Rise of Stablecoins

At TOKEN2049 Dubai, regulatory clarity and stablecoin adoption stood out as defining themes. Our team joined high-level roundtables with the DFSA, Abu Dhabi Global Market Authorities, and VARA — highlighting the UAE’s drive to balance innovation with oversight.

Key insights include:

- Stablecoin regulation: Regulators prioritise stablecoin issuance and tokenisation for controlled growth.

- Rising usage: Stablecoins are increasingly used for settlement, especially among small and medium-sized enterprises (SMEs), as crypto trading declines.

- Institutional adoption: Clearer regulations and bank partnerships are accelerating institutional adoption of stablecoins.

- Compliance vs. Interoperability: Achieving both regulatory compliance and seamless interoperability remains challenging, particularly with MiCA and other regulations.

- Crypto-fintech convergence: The line between crypto and fintech is blurring, with fintechs adopting stablecoins for payments.

- Geopolitical risks: Regulators are concerned with risks like depegging, and ensuring stablecoins are backed remains a challenge for merchant payments.

Growing Demand for KYT

Beyond regulatory discussions, TOKEN2049 Dubai underscored the increasing importance of practical tools like KYT in meeting evolving compliance needs.

Based on conversations with a range of industry players, Carlos Yanez shared a key insight: many law firms and licensing specialists working with regulated entities still operate without KYT partnerships. As KYT becomes more integral to licensing processes, addressing this gap presents both a challenge and an opportunity for the broader ecosystem.

Conclusion

TOKEN2049 Dubai offered a clear view of where the industry is headed—toward stronger regulation, deeper institutional engagement, and a growing need for compliance innovation. As the ecosystem evolves, the demand for trusted, adaptable solutions will only intensify, opening new opportunities for those ready to lead.

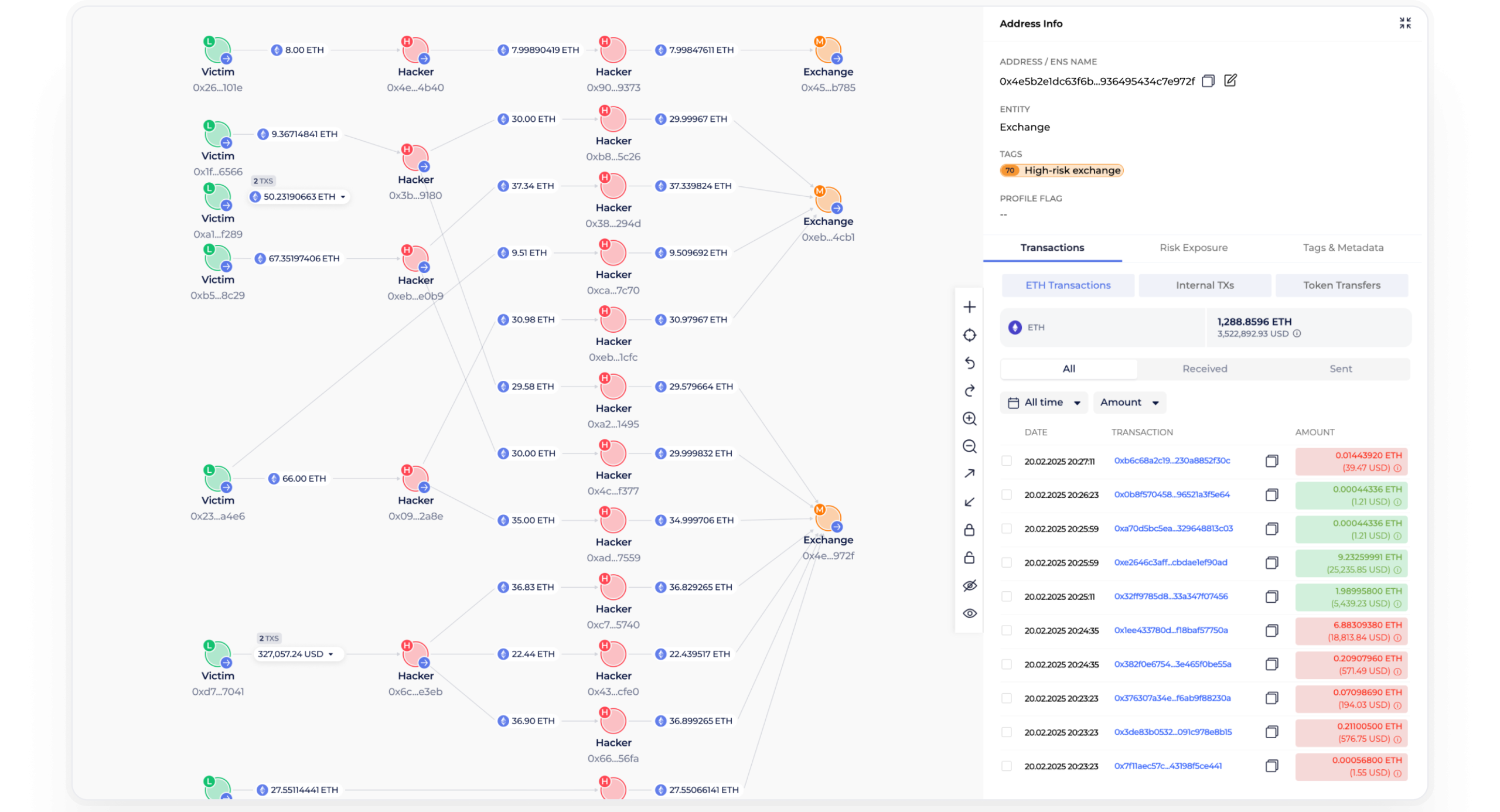

The event also revealed a substantial, underserved market for KYT services, especially among payment infrastructure providers and legal advisors seeking trusted, regionally attuned solutions. Our Global Ledger solution — which offers blockchain transaction visualisation for risk assessment and in-depth AML investigations — is designed to make compliance more accessible, actionable, and aligned with the needs of the evolving regulatory landscape.